The business justification of a project is one of the core elements in virtually all project management methods and best practices—both traditional (waterfall) and agile. In practice, however, it is one of the most challenging principles to implement effectively. In this article, we will discuss how to create and manage a project’s business justification, both during project preparation and throughout its execution.

What is a project's business justification?

In principle, any project undertaken by an organization should have a valid business justification. This justification depends on both the financial efficiency of the project and its alignment with the organization's strategic goals.

There may be cases where a project does not guarantee a positive return on investment, yet supports important business objectives. Such a project can still be considered justified. However, the reverse should not occur—a financially profitable project that does not align with the organization's strategy should not be considered justified. Otherwise, the organization would be dispersing its efforts and resources on peripheral activities, neglecting the realization of its core strategic goals.

Business justification is most commonly associated with the financial profitability of a project. However, this is not always the case. Some projects are undertaken even when they are not financially viable—when the return on investment is negative or cannot be calculated at all (i.e., money is spent but not earned). Such projects may include regulatory or compliance initiatives, which are necessary to maintain business operations or avoid penalties. That said, even in these cases, a cost-benefit analysis may lead an organization to choose to pay the penalty rather than comply—for example, when adapting existing IT systems to new legal requirements in an area of business that is being phased out.

What form should a project’s business justification take?

A project’s business justification is typically prepared in narrative form, explaining why the project is important to the organization (particularly which strategic objectives it supports) and, therefore, why it should be carried out. This narrative approach is commonly used, but on its own is often insufficient for properly assessing a project—both at the approval stage and during its ongoing execution.

In addition to the descriptive component, the business justification should include:

- a financial flow overview for the project,

- a financial indicator to measure return on investment.

The financial flow overview includes both cash outflows and inflows over time, along with the overall project balance.

Cash outflows include expenditures that will be incurred during the project (e.g., infrastructure purchases, application licenses, third-party services), as well as negative post-project effects over a defined period (e.g., maintenance costs for a solution over 3 years). Internal costs are sometimes also included, such as the cost of employees working on the project or services provided by other parts of the organization (e.g., infrastructure support used for development and testing).

Cash inflows refer to expected revenues or savings resulting from proper utilization of the project's deliverables. These usually occur after project completion but may also appear during the project (e.g., in customer-facing projects where the client pays as deliverables are provided).

The project balance allows us to understand the cash flow over time, showing inflows and outflows for each period (year, quarter or month).

This cash flow data is then used to calculate a financial indicator that includes both these flows and the cost of capital used to finance the project. One of the most commonly used indicators for evaluating return on investment in projects is NPV (Net Present Value). A positive NPV indicates that the project is financially profitable (and the higher it is, the better the return), while a negative NPV means the project is financially unviable.

What is the business justification used for?

The business justification is most often used during the project preparation and approval phase. However, its role is also critical (and often underestimated) during the execution of the project.

During the preparation phase, data is collected to develop the project’s business justification. As mentioned earlier, this includes both a descriptive and numerical part involving financial flows and return on investment.

Figure 1. shows a sample balance sheet of a project still in the planning stage.

Figure 1. Project balance in preparation

Source: Hadrone PPM software (www.hadrone.com)

In this example, the NPV is PLN 2,544,591.86. Assuming the project also aligns with the organization’s strategy, it may receive a positive decision to proceed. I say may because before final approval, projects are typically reviewed as part of a project portfolio balancing process. From the pool of business-justified projects, only those that are feasible within available financial and human resources are selected for implementation—but that’s a topic for another article.

The role of the business justification does not end once a project is approved. It is equally important to monitor the ongoing business justification during project execution, to ensure that not only new but also ongoing projects remain justified.

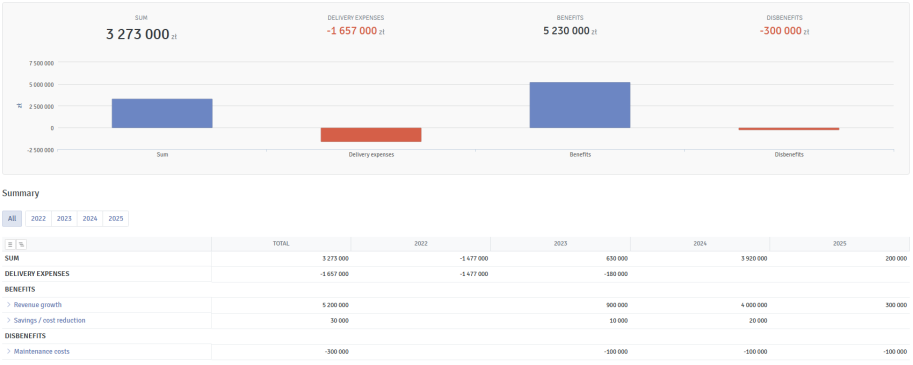

Figure 2. shows a sample balance sheet of a project in progress.

Figure 2. Project balance in execution

Source: Hadrone PPM software (www.hadrone.com)

While the project is ongoing, deviations from the baseline can be tracked using actual and forecasted values. This includes both expenditures and the benefits and disbenefits (negative impacts) expected as a result of the project.

Monitoring business justification during execution should focus not only on budget deviations—which often receive the most attention—but also on project effects. A project can lose its justification even if it stays within budget. External factors may negatively affect the achievement of expected benefits (e.g., a competitor releases a similar product earlier) or impact the avoidance of disbenefits (e.g., a significant increase in the maintenance cost of a solution).

Additionally, if ROI indicators like NPV are being used, not only the values but also the timing of cash flows matters. NPV can become negative even when costs and effects remain the same, simply due to delays in realizing the benefits.

From an organizational perspective, it is essential to have access to up-to-date information to make informed decisions—especially regarding whether to continue with certain projects—based on current business justification.

Managing changes to business justification

The business justification—both the narrative and financial components—is subject to change control within the project’s baseline. Due to its fundamental importance, the project manager cannot modify the business justification independently. Any changes must be formally approved.

Furthermore, before approving any changes to the business justification of an ongoing project, a current financial analysis must be performed. It may turn out that the project balance or NPV is already negative, in which case increasing the budget or delaying the effects may no longer be acceptable.

System support for managing project business justification

Project and portfolio management systems (such as Hadrone PPM) provide automation for calculating a project's business justification, in the following ways:

- automatically converting resource usage into project expenditures,

- automatically forecasting expenditures and effects after schedule changes,

- automatically calculating project balances (baseline, actual, and forecasted),

- automatically calculating and tracking baseline and forecasted financial indicators (e.g., NPV) at both the project and portfolio levels.

As a result, project managers spend less time on manual calculations and updates and the organization gains real-time, reliable data for informed decision-making.

Conclusion

Managing the business justification of a project is not limited to the preparation phase. Of course, it's critical for organizations to select only those projects that are justified. Equally important, however, is ensuring that projects remain justified throughout their execution. This is often the greatest challenge for organizations.

In addition to improving internal processes, it's worthwhile to invest in an appropriate software tool that supports project managers in calculating business justification and provides the organization with confidence that the data is accurate and kept up to date with every project change.